How do I update my employee's tax info?

Employers can update an employee's tax information on the Form W-4.

Find the name of the employee from your list - click on the name - under the PAYROLL tab choose TAXES.

To access the withholding options select the blue word FEDERAL.

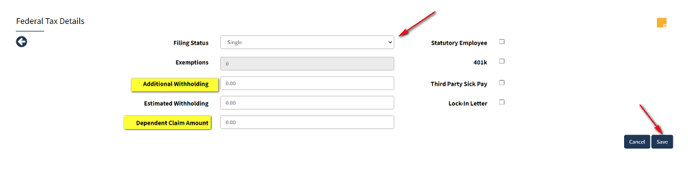

This opens the details of the form, and you will be able to update using the drop-down menu to choose the STATUS and then add the additional information that is highlighted if pertinent. After making any changes, always click SAVE.

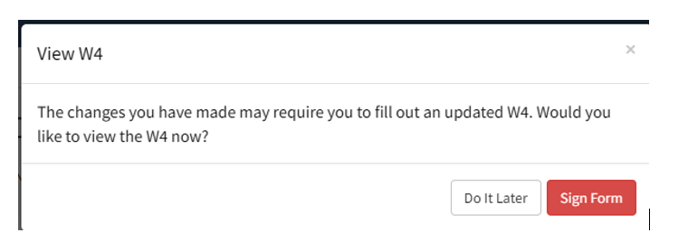

Once you click SAVE, you will see a message box pop up.

If you are doing this on the employee's behalf, choose DO IT LATER. The change will still take effect. If you use the interactive option, then this will place the request on the employee's dashboard for them to complete. If you (the client) do all the data entry, then make sure you have a paper copy of the Form W-4 change request from the employee for your records.

As of January 1st, 2020, the IRS did away with the number of exemptions claimed on the payroll taxes and instead adopted a new way to figure the taxes. Though there are no more "Exemptions", employees will see either a 0, 2, or 3 listed in the exemptions field under their taxes. This does not correlate to number of exemptions claimed like it used to but only serves as a place holder to correspond with the new IRS tax tables and how the information from the employees Form W-4 has to be entered in our system in order to relate with the correct IRS withholding amount.

Here's how it works:

If an employee checks SINGLE or MARRIED FILING SEPARATE or HEAD OF HOUSEHOLD, the exemption will come through as a 2.

If an employee selects MARRIED FILING JOINTLY, the exemption will come through as a 3.

If an employee selects STEP 2 (c) box, then the exemption will come through as 0.

It is a bit confusing as the box that these numbers come through is still labeled as exemptions, but it solely goes by the status and the dependent claim amount since the IRS made this change. Employees can also opt to have an additional amount withheld by entering that dollar amount in box 4c. Additionally they can utilize the payroll and W4 calculators at www.paycheckcity.com or www.irs.gov to assist in setting up their payroll withholdings that will work best for their own personal situations.